ANIXE Insights: Significant downtrend in bookings. COVID restrictions negatively affect the tourism sector

2021 has been a year of consistent recovery for the travel industry, with the exception of some notable dips in the curve. At the onset of new waves, variants and travel restrictions, we’ve seen countries go from red to green and back to red. We’ve seen a largely last-minute trend where people feel more confident in making travel decisions almost on the go. If the news says things are under control, then better to travel now before that changes. That’s what many of us have done. We’ve managed to get away with some weeks at the beach with our families and friends, and with vaccination programs underway globally, we assumed it would be all downhill from that point onward. Many of us have booked Christmas and New Year getaways and find ourselves now wondering if we’ll eventually have to cancel our plans.

The Omicron variant. Addressing the elephant in the room, we must consider a few important factors we have observed. It’s not all bad.

• Although the media is making Omicron out to be the biggest, baddest variant of all time, fewer and fewer people are worried about it. We know because the search traffic hasn’t receded at all. On the contrary, it would appear to have grown a bit as people search frantically for destinations still open to travel.

• Although booking volumes for December shrunk to around 40% of the numbers we saw sold in October 2021; cancellations aren’t coming in, contrary to the situation with the last set of lockdowns. The conclusion here is the same. People aren’t afraid to travel. They’re not going to cancel their trips, not unless they have to.

• Winter is coming. In many places around the world, we’re smack in the middle of it. As a result, the virus is likely to become more active, and people are willing to wait it out. Winter destinations like Egypt, Dubai and the Canary Islands may suffer due to this, but summer destinations should be ok, as the virus is expected to die down by then.

To conclude, the drop in booking volume we see today may not be just COVID related but may reflect a new travel trend. People will opt to stay home in the winter or travel locally but must have that summer beach getaway with the family. So it may end up being the main vacation type of the future… beach & sun. The one you aren’t prepared to give up.

As the global population lines up for their third vaccine boosters, they search intently for their summer getaway, hoping to catch amazing early booking prices with lax cancellation policies. And they will.

We’ve become much more resilient in the last two years, and we’ve also become used to this new threat that we constantly live with. It’s become like the flu’s evil cousin that we’re getting accustomed to. A lot more of us are vaccinated today, even if we are globally still behind projections, and we feel a lot more confident with our chances against covid because of that. So we believe that although this winter will be tough, we will live to see better days shortly after.

October 2021 was another month of good fortune for the travel sector with another monthly average 5.4% increase in bookings - which was a big deal given the continued growth despite the long overdue holidays. The global market was climbing to around 86% of the October 2019 volume, and in Germany, activity levels started to approach 87% of pre-pandemic hotel bookings. Unfortunately, November 2021 reversed this positive trend for the travel sector. Activity fell hard by over 40%, stopping at around 52% of November 2019’s volume. In Germany, booking levels have declined to 50% of 2019 production.

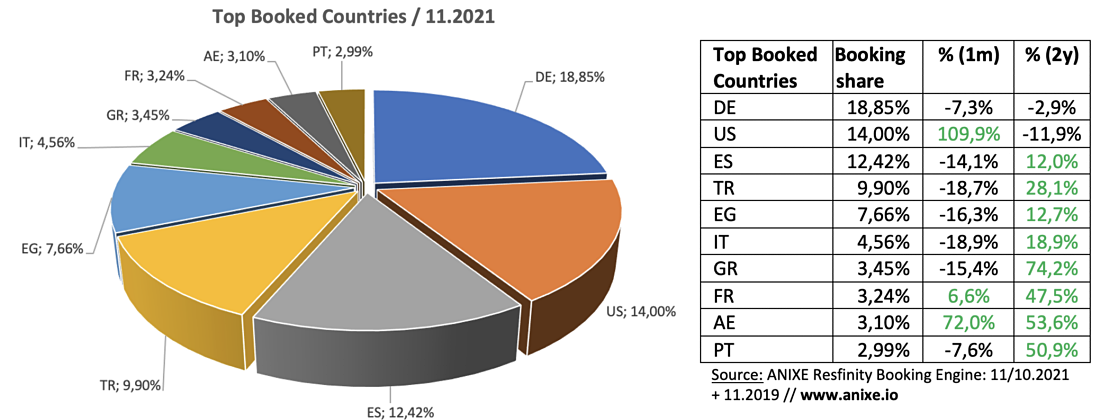

In November, Germans targeted domestic destinations but also the USA and Spain. Typical business destinations have understandably done better than warm and relaxing destinations. The destination that enjoyed significant growth in previous months was the USA, but its share was still nearly 12% lower than in 2019. Interestingly, the share of holiday destinations such as Spain, Turkey and Greece remained significantly higher than in the corresponding period in 2019.

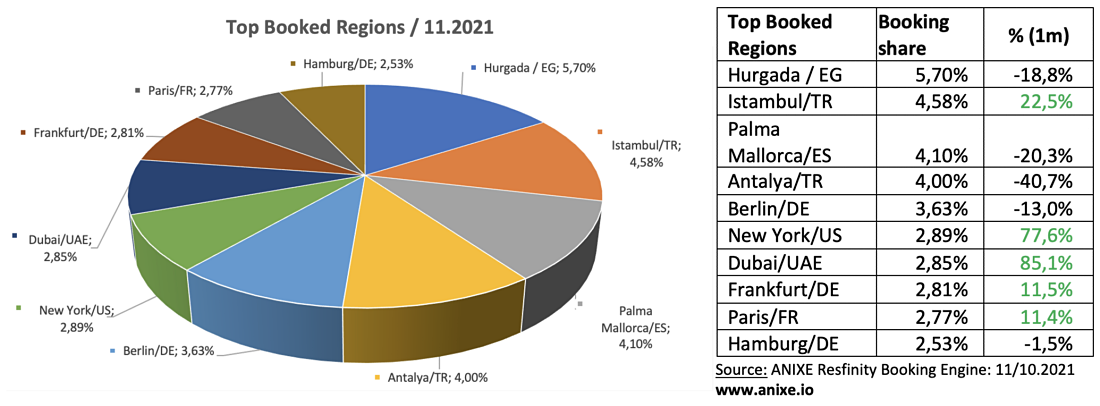

The first days of autumn have encouraged German travellers to make reservations for Egypt's Hurghada, Spain's Palma Mallorca and Turkey's Antalya & Istanbul, which in contrast to those mentioned above, showed an increase in popularity of over 22%. New York and Dubai also grew strongly, although their share in the booking portfolio remained less spectacular.

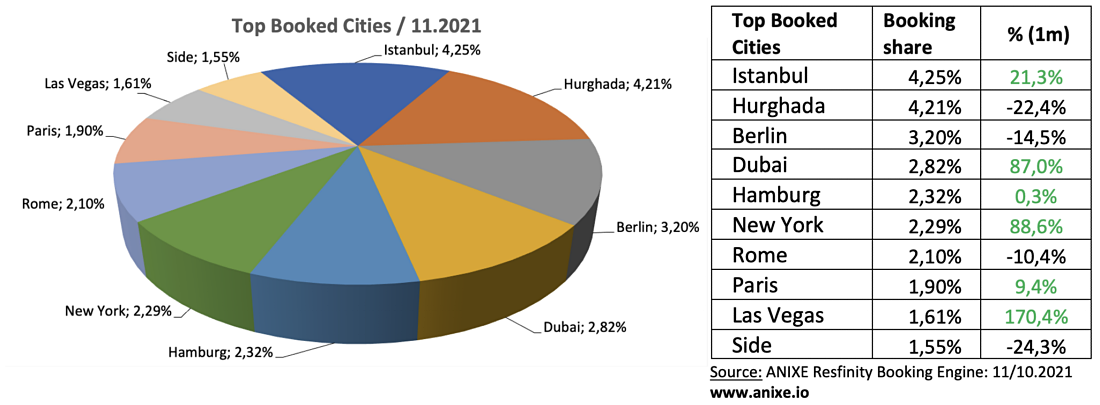

However, the list lacked the top-rated destinations in November 2019 - Las Vegas, London and Prague. Their share in 2021 - despite its high position - fell by 24% for the first and by an average of 50% for the others.

German travellers' four most popular destination cities in November 2021 are Istambul, Hurghada, Berlin and Dubai. However, in monthly terms, the latter, along with America's New York and Las Vegas, noted significant increases.

Compared to the situation two years ago, i.e.November 2019 - the most significant increase in holiday popularity was mainly seen in Hurghada and Istambul. On the other hand, the most considerable decrease in share in the Resfinity Booking Engine was in London, Prague and Frankfurt.

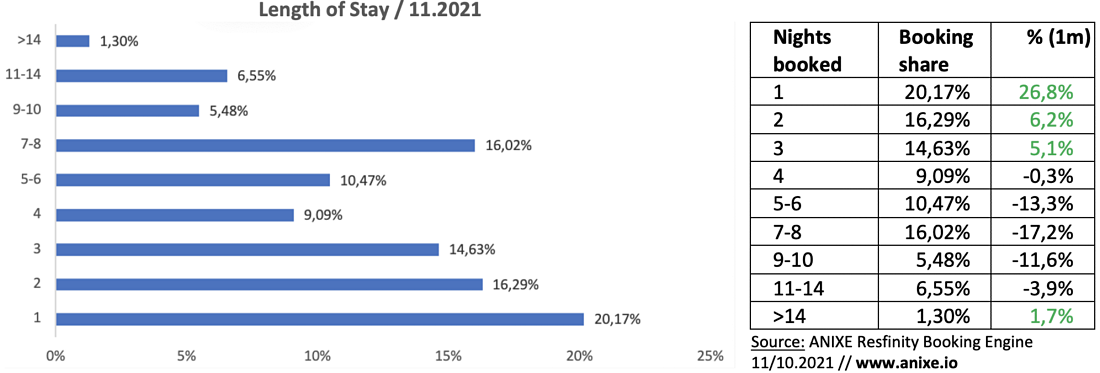

German travellers have enjoyed trips lasting about a week for the past six months. The end of the summer holidays and people returning to work has increased the popularity of shorter one-day trips. Although a similar trend was observed two years ago, the current figures show a rather inflated share of 5–8-day trips in favour of 1-day trips. In November 2019, their popularity was 20% higher than now.

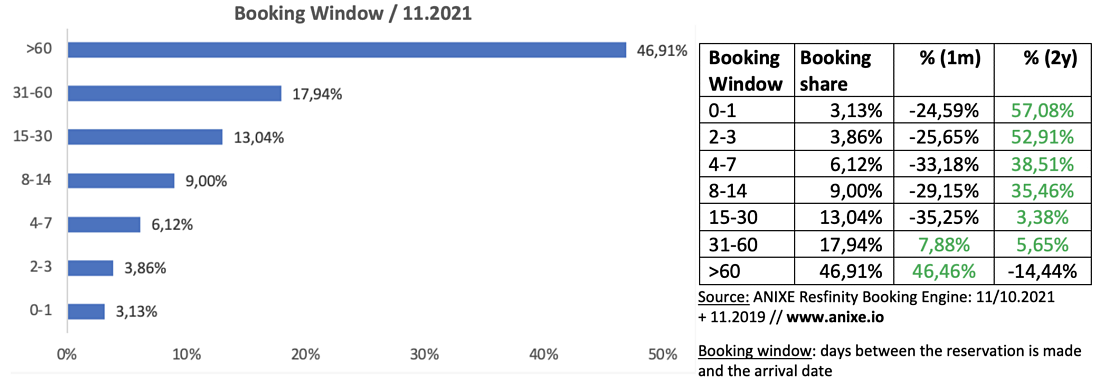

In November 2021 - just like two years ago - interest in early booking offers (over 60 days) is growing, making way for bookings made 3-4 weeks in advance. In the last period, this trend was confirmed, and people eagerly made their reservations disregarding the developing 4th wave of the pandemic and intensifying outbreaks.

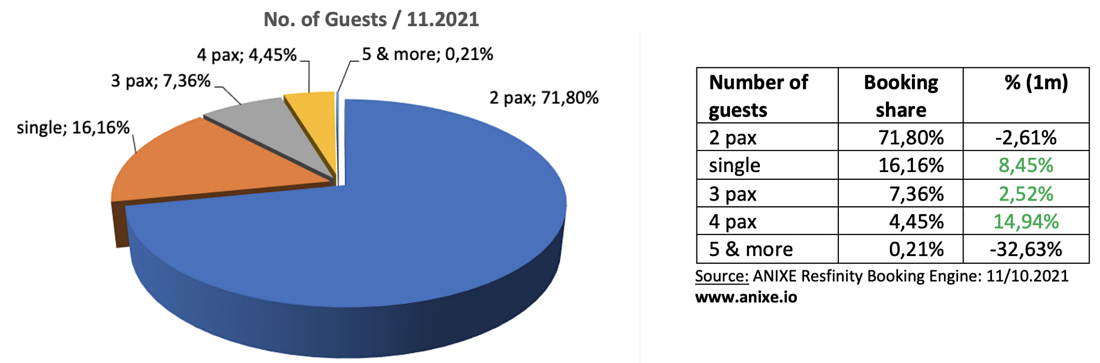

The same is true for trends impacting group travel. Current indications are roughly in line with those from 2 years ago. Dominating are groups of 2 people and singles. Surprisingly, the share of single bookings in November 2021 was 8% higher in both October 2021 and November 2021.

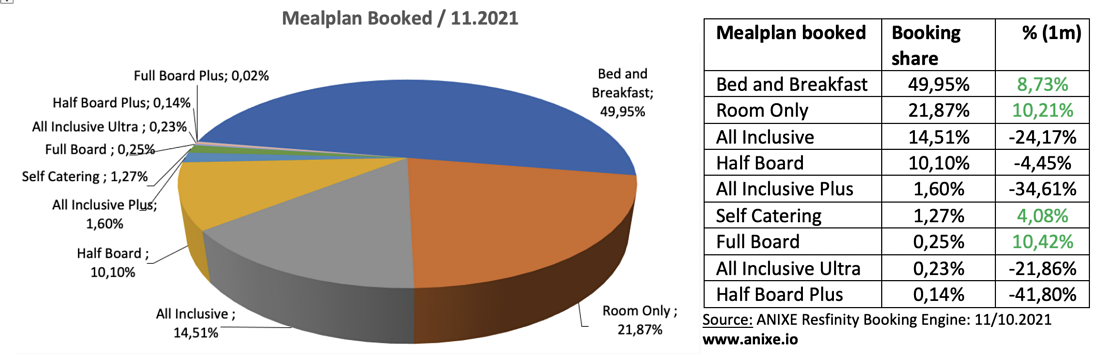

ANIXE's market data shows that the increase in business travel is matched by the rise in the popularity of rooms with breakfast only or even no meals. It also reflects the situation in the same period before the pandemic, where the popularity of rooms in the RO (Room Only) category booked by tour operators was even 10% higher.

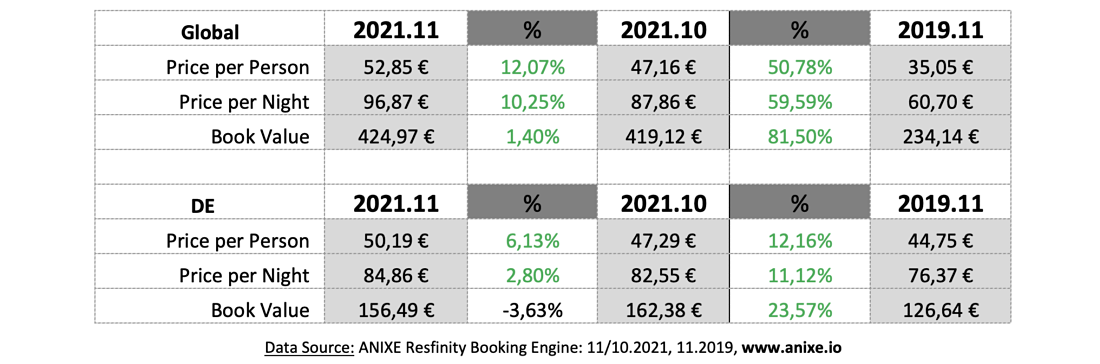

As far as prices are concerned, hotel prices start to increase after the peak of the holiday season - both on a monthly and biannual basis. So it shouldn't be surprising considering the increase in 1-2 person trips and decrease in multi-bed rooms in November's bookings. On the other hand, the high level of inflation weighing on both European and global economies can significantly impact price differences from a two-year perspective.

Although the positive trend we've become accustomed to since the beginning of the year is faltering, we must not stop searching for our next perfect getaway. Plan your summer. Book that villa in the Maldives! Take the kids to Disneyland! Take your significant other on that romantic getaway in wine country.

How soon will we start to see bookings rise again? What destinations will grow in popularity in the winter season? Will people go skiing? Stay tuned for the next ANIXE Insights.

Stay tuned. Stay safe. Plan your trips.

Team ANIXE

(Data origin: ANIXE Resfinity Booking Engine. Data originated from the ANIXE Resfinity IBE travel system.)

.